Whenever a new and exciting issue such as Facebook hits the market, individual investors tend to be carried away with the hype and novelty and place buy orders at the open of the first trading day.

Unless you are a very short term trader and can get in before the gap up you are likely to be disappointed. In the overwhelming majority of cases with few exceptions , when a new issue hits the market

a gap up followed by a pullback occurs within a few days or a couple of weeks.The stock then tends to form a basing pattern that can last for several months. These basing patterns can take several

forms such as symmetrical triangle, falling rectangle or support and resistance among others. If the stock is likely to be a long term winner, you will see a breakout from such consolidation patterns as seen in the examples below.

You should enter when a break occurs on the weekly chart as shown in the examples below.

The chart of FB below shows a gap up then a pullback followed by a symmetrical triangle consolidation for a few months. The right buy time is on a break out of this pattern as shown

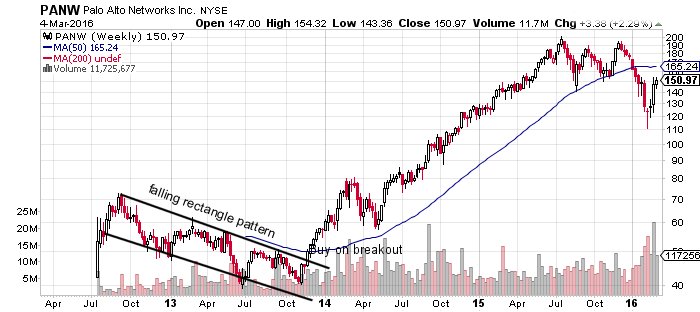

The chart of PANW shows a short term advance then a pullback into a falling rectangle pattern as shown. The right time is buying on a break out of that pattern on the weekly chart.

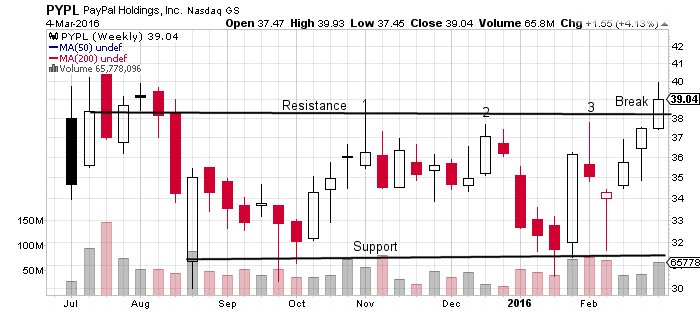

Below is the chart of PYPL a new issue that came on the market recently and just broke out of a support/resistance pattern.Notice that there were three unsuccessful attempts to break the resistance that failed.

Success occured on the fourth attempt signaling a buy. The example below is just happening so there is no benefit of hindsight.

Many may question why wait for a break before entering?. Why not enter at a lower price through consolidation. The reason is simple: No one can predict the length of the

consolidation period.It is better to buy just before the major advance than to get stuck in a consolidation period that can last many months.