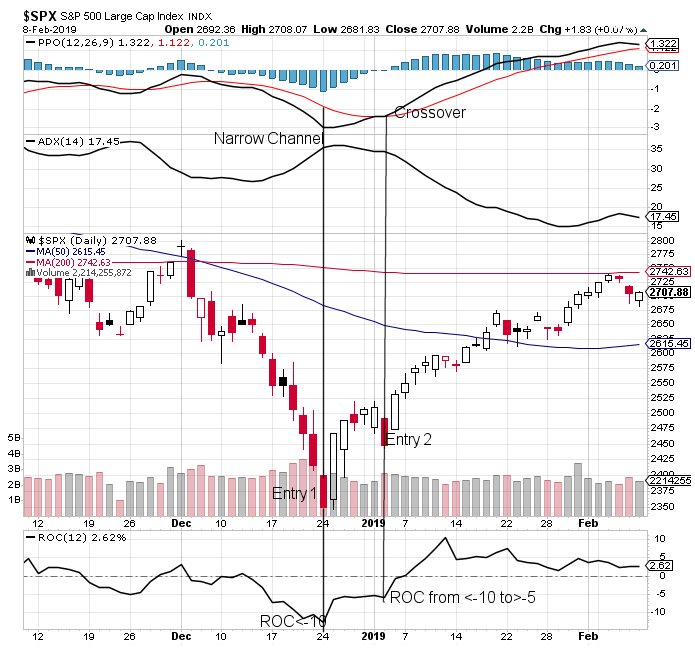

This setup is a slight modification of the Falling Knife setup in Chapter 11 of the book "Explosve Stock Trading Strategies". This is highly effective for timing V reversals in Indices as shown in the SPX example below. Using This startegy and either of the two entry points one would have been able to get in close to the bottom.

The setup is as follows:

(1) PPO and ADX should form a narrowing channel as shown below. This does not happen often and is usually the first requirement for a strong V reversal

(2) Pick the point where the V neck of the Channel forms

(3) Draw a vertical line down through the price Chart to the ROC.

(4) If the corresponding ROC reading is below -10 the setup is very likely a V reversal setup.

There are two possible entry points as seen below:

(1) The first which is a slightly hiher risk than entry 2 but has a higher reward is to enter the at the price where the V neck and the ROC <-10 intersect.This is Entry 1 on the Chart below

Note that if the ROC reading corresponding to the channel neck is NOT below -10 the setup is not complete.

(2) After determining the initial entry point where the ROC is below -10 corresponding to the V neck, wait until the ROC rises to -5. This confirms the reversal and decreases the likelhood of failure.

This entry point is reinforced if there ia bullish or nearing bullish PPO cross as seen below.

This is Entry 2 on the Chart below.

Imoportant: It is essential that the initial entry point show a reading of < -10 at the V neck of the Channel. Notice that on NOV 26, there was another possible narrowing channel but the corresponding reading was near -5 which did not meet the criteria. The index went higher but then quickly reversed. The ROC -5 can ONLY be used as a secondary entry point after the initial entry point was located at the Channel V neck and ROC <-10